The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

Blog Article

Fascination About Mileagewise - Reconstructing Mileage Logs

Table of ContentsUnknown Facts About Mileagewise - Reconstructing Mileage LogsNot known Facts About Mileagewise - Reconstructing Mileage LogsThe 6-Minute Rule for Mileagewise - Reconstructing Mileage LogsMileagewise - Reconstructing Mileage Logs - An OverviewThe Main Principles Of Mileagewise - Reconstructing Mileage Logs Getting My Mileagewise - Reconstructing Mileage Logs To WorkThe Main Principles Of Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Range attribute suggests the quickest driving path to your staff members' location. This attribute improves efficiency and adds to cost financial savings, making it a necessary possession for organizations with a mobile workforce. Timeero's Suggested Path attribute better improves accountability and effectiveness. Staff members can contrast the recommended path with the real course taken.Such an approach to reporting and compliance streamlines the typically complex job of managing mileage expenditures. There are many advantages associated with utilizing Timeero to track mileage. Allow's take an appearance at some of the application's most remarkable attributes. With a relied on gas mileage monitoring device, like Timeero there is no demand to fret regarding mistakenly leaving out a day or piece of information on timesheets when tax obligation time comes.

All About Mileagewise - Reconstructing Mileage Logs

With these devices in operation, there will be no under-the-radar detours to increase your compensation prices. Timestamps can be discovered on each gas mileage entry, increasing trustworthiness. These additional verification steps will certainly keep the IRS from having a factor to object your mileage records. With accurate mileage monitoring modern technology, your employees don't need to make rough mileage estimates or perhaps worry concerning gas mileage expenditure monitoring.

For example, if an employee drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all cars and truck expenditures. You will require to continue tracking mileage for job also if you're using the real expenditure technique. Maintaining gas mileage documents is the only method to separate company and personal miles and give the proof to the IRS

The majority of gas mileage trackers let you log your journeys manually while determining the distance and repayment amounts for you. Many also featured real-time journey monitoring - you need to begin the app at the beginning of your trip and quit it when you reach your final destination. These applications log your begin and end addresses, and time stamps, together with the total distance and compensation amount.

Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

This consists of costs such as fuel, upkeep, insurance, and the lorry's devaluation. For these prices to be thought about insurance deductible, the vehicle must be utilized for service functions.

The 10-Second Trick For Mileagewise - Reconstructing Mileage Logs

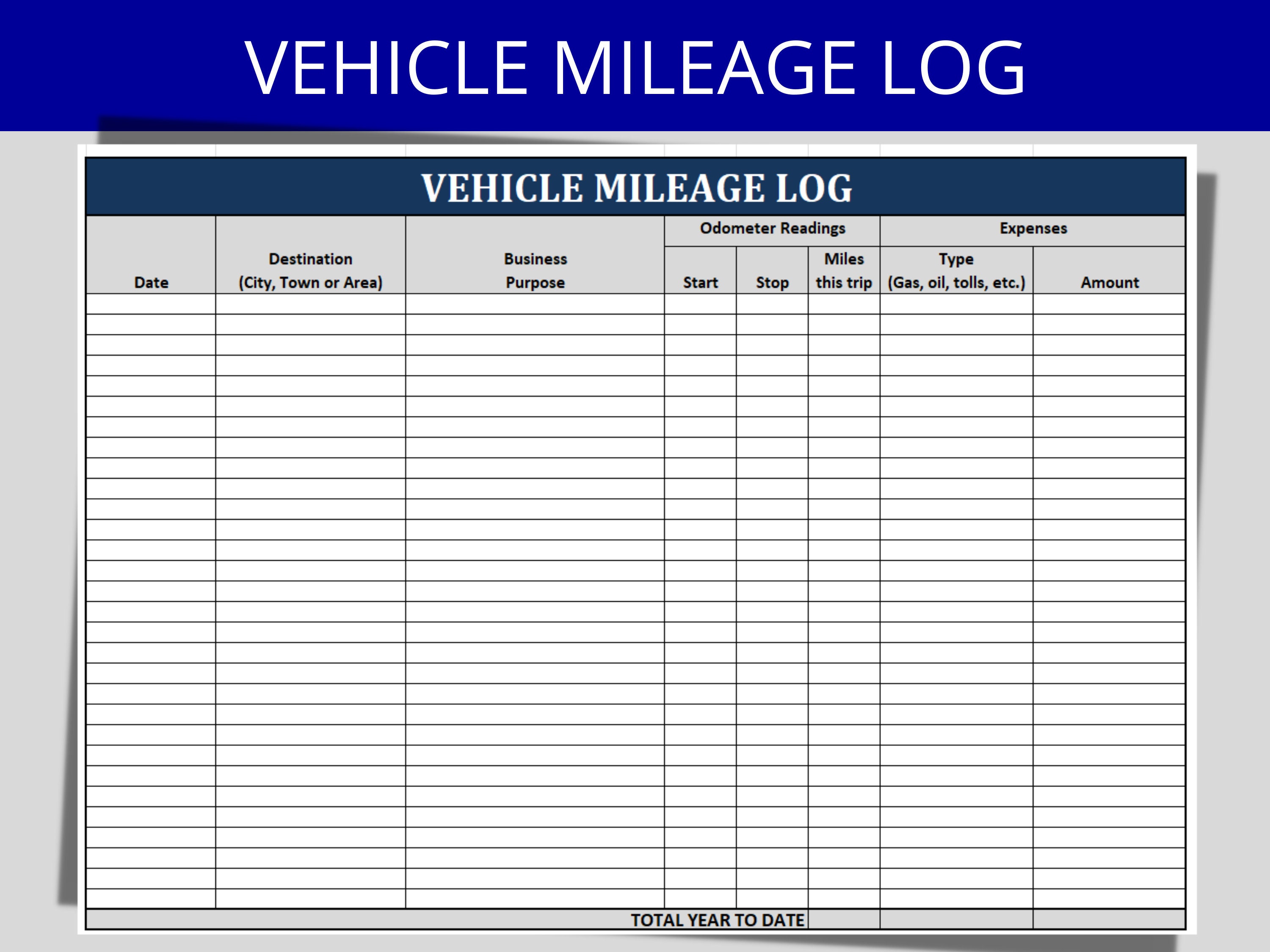

Begin by videotaping your cars and truck's odometer analysis on January first and afterwards again at the end of the year. In in between, vigilantly track all your business trips noting down the starting and ending readings. For each journey, record the location and business objective. This can be streamlined by maintaining a driving log in your car.

This includes the complete service mileage and total gas mileage build-up for the year (company + personal), trip's date, destination, and objective. It's important to tape-record tasks quickly and preserve a simultaneous driving mileage tracker log outlining day, miles driven, and company function. Below's how you can boost record-keeping for audit objectives: Begin with guaranteeing a careful gas mileage log for all business-related travel.

Not known Incorrect Statements About Mileagewise - Reconstructing Mileage Logs

The actual expenditures approach is a different to the common gas mileage price method. As opposed to determining your reduction based on a fixed price per mile, the actual expenses method enables you to deduct the actual prices connected with utilizing your vehicle for business purposes - mileage log. These expenses consist of fuel, upkeep, fixings, insurance policy, devaluation, and various other related expenditures

Nonetheless, those with significant vehicle-related expenditures or distinct conditions might benefit from the real costs method. Please note electing S-corp condition can change this computation. Ultimately, your selected method needs to align with your details financial goals and tax circumstance. The Criterion Gas Mileage Price is a procedure provided annually by the IRS to determine the deductible costs of operating an auto for service.

Mileagewise - Reconstructing Mileage Logs for Dummies

(https://www.wattpad.com/user/mi1eagewise)Calculate your complete service miles by using your begin and end odometer readings, and your recorded service miles. Accurately tracking your specific mileage for organization trips help in validating your tax reduction, especially if you decide for the Criterion Gas mileage technique.

Monitoring your gas mileage by hand can call for diligence, yet bear in mind, it might conserve you cash on your tax obligations. Comply with these steps: List the date of each drive. Tape the complete mileage driven. Take into consideration noting your odometer analyses before and after each journey. Write down the starting and finishing factors for your journey.

Indicators on Mileagewise - Reconstructing Mileage Logs You Need To Know

And currently virtually everybody makes use of General practitioners to get about. That indicates almost everybody can be tracked as they go about their organization.

Report this page